World Bank warns of ‘stagflation,’ slashes growth forecast

The agency has warned of the risk of 1970s-style stagflation persisting in the coming years amid soaring commodity prices and low growth. Developing countries are expected to be some of the worst hit.

The World Bank modified its growth forecast for this year, down to 2.9% from the figure of 4.1% given in January

The World Bank modified its growth forecast for this year, down to 2.9% from the figure of 4.1% given in January

The World Bank on Tuesday slashed its growth estimate for 2022 by over one percentage point.

The organization voiced concerns around the risk of “stagflation,” a mix of high inflation and sluggish growth.

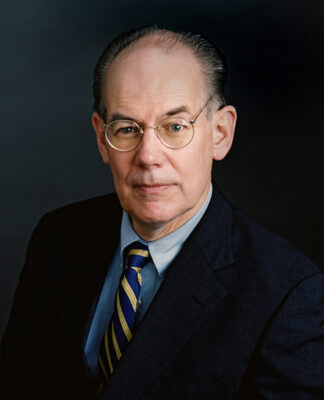

“For many countries, recession will be hard to avoid,” World Bank President David Malpass said.

What are the World Bank’s predictions?

The World Bank predicted growth of 2.9% this year. In January, it had forecast 4.1% for 2022.

The agency also predicted just 3% growth for 2023 and 2024.

It expects oil prices to surge 42% this year. Non-energy commodity prices are expected to rise by 18%.

The World Bank compared the current rising prices to the oil shocks of the 1970s.

“Additional adverse shocks,” the agency warned in its new Global Economic Prospects report, “will increase the possibility that the global economy will experience a period of stagflation reminiscent of the 1970s.”

“Subdued growth will likely persist throughout the decade because of weak investment in most of the world,” Malpass said.

“With inflation now running at multi-decade highs in many countries and supply expected to grow slowly, there is a risk that inflation will remain higher for longer.”

What is the cause of the stagflation?

Malpass said that global growth was being affected by the war in Ukraine, COVID lockdowns in China and supply-chain disruptions.

Russia’s invasion of Ukraine severely disrupted global trade in energy and wheat, hitting a global economy that had been recovering from the coronavirus pandemic.

Commodity prices have soared, threatening affordability in developing countries.

“There’s a severe risk of malnutrition and of deepening hunger and even of famine,” Malpass said.

sdi/rt (AP, AFP, Reuters)