1 Growth Stock to Buy and Hold in a Market Downturn

By Neil Patel – Apr 15, 2023 at 6:00AM

KEY POINTS

While still posting a negative return, Mastercard’s stock performed better than the S&P 500 in 2022.

Mastercard has superb financials, which means it will have no problem navigating the current economy.

Thanks to its strong competitive advantages, Mastercard is a dominant force in digital payments.

Motley Fool Issues Rare “All In” Buy Alert

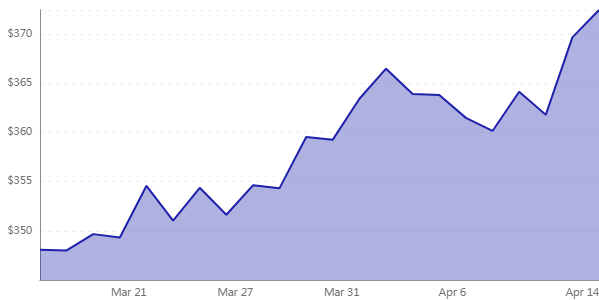

NYSE: MA

Mastercard

Mastercard Stock Quote

Market Cap

$355B

Today’s Change

(0.75%) $2.78

Current Price

$372.43

Price as of April 14, 2023, 4:00 p.m. ET

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

In uncertain times like now, investors should prioritize the durability Mastercard provides.

Seeing the market tank is certainly a scary thing for investors to experience, especially when their life savings are on the line. That’s why the S&P 500’s 19% drop in 2022 was so hard to stomach. It was a sizable decrease, while also being the first yearly fall since 2008. Rapidly rising interest rates spooked investors, causing risk assets to lose value.

There was one stock, however, that only fell 3% last year. No loss is easy to stomach, but this is a clear indication that should another market downturn happen, it could be a safe business for investors to buy and hold. I’m talking about Mastercard (MA 0.75%). Here’s why it’s a growth stock you should think about owning right now.

Outstanding financial profile

In highly uncertain economic times, like the one we’ve been in, investors should prioritize pristine financials from the companies that they are looking to add to their portfolios. Mastercard passes this requirement with flying colors. In 2022, the payments network operator registered an operating margin of 55.2% and a net profit margin of 44.7%. Among the thousands of publicly traded businesses out there, you will struggle to find many that can compete with that type of profitability.

Moreover, because Mastercard has largely already built out the electronic infrastructure for its payments network to function, processing each additional transaction comes at virtually no cost. Margins have steadily expanded over the years as the business scales. And capital expenditures needed to reinvest back into the operations are minimal. In 2022, Mastercard’s cash outlays for purchases of property and equipment and capitalized software totaled $1.1 billion. This favorable situation helps the company generate tons of free cash flow, to the tune of $10.1 billion last year.

Although Mastercard had $13.7 billion of long-term debt, compared to $7 billion of cash and cash equivalents, on its balance sheet as of Dec. 31, the risk that it defaults is almost nonexistent. Over the past three years, the company’s interest coverage ratio averaged an outstanding 22.8. This means Mastercard has had no problems paying its creditors.

The financials are obviously wonderful. Why is this so important? It will help the business easily navigate any headwinds that arise this year, which seem to be on everyone’s minds these days. Think about an unprofitable, debt-ridden enterprise whose survival is in doubt right now. Investors don’t have to worry about this with Mastercard. That peace of mind is invaluable today.

Collapse

bubble chart

NYSE: MA

Mastercard

Today’s Change

(0.75%) $2.78

Current Price

$372.43

YTD

1W

1M

3M

6M

1Y

5Y

PRICE

VS S&P

MA

KEY DATA POINTS

Market Cap

$355B

Day’s Range

$369.11 – $373.39

52wk Range

$276.87 – $390.00

Volume

2,254,716

Avg Vol

2,717,727

Gross Margin

100.00%

Dividend Yield

0.61%

Should you invest $1,000 in Mastercard right now?

Powerful competitive advantages

Bolstering the investment case for why investors might want to buy and hold Mastercard during a market downturn are the company’s powerful competitive advantages. These are traits that make it difficult for industry newcomers to successfully compete. And it’s something that famed investor Warren Buffett seeks out in the business he owns, including shares of Mastercard.

For starters, Mastercard benefits from scale advantages, something I touched on earlier. As its revenue has soared over the years, so have its margins. This improved profitability means that the company is better able to leverage its fixed costs over time, translating to a consistently expanding bottom line.

Mastercard also gains from one of the strongest economic moats around — network effects. Mastercard currently has more than 3 billion cards in circulation. And it is estimated that these cards are accepted at more than 100 million merchant locations worldwide. This platform processed nearly $8.2 trillion of gross volume in 2022. Consumers want these cards because they are accepted everywhere.

On the other hand, merchants have no choice but to accept Mastercard-branded cards, or they’ll risk losing out on an enormous customer base. Consequently, as the card count and number of merchants rise over time, the network becomes more valuable to all participants. This makes it almost impossible for a new market entrant to build a payments network like this from scratch. In other words, Mastercard’s competitive position is essentially impenetrable.

Pair these incredible qualitative characteristics with stellar financials, and Mastercard looks like a no-brainer stock to own during a potential market downturn. This might convince investors to pay a premium price-to-earnings ratio of 36 for the stock.

Neil Patel has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Mastercard. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.