Asian markets extend US rally as confidence in rates rises

by Brian Neeley November 21, 2023 in Market

Asian markets extend US rally as confidence in rates rises

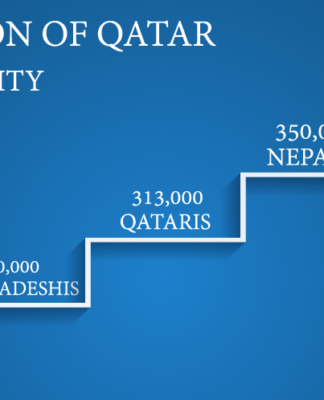

Asian investors edged higher on Wall Street on Tuesday as analysts said a strong US Treasury auction signaled confidence on the trading floor that the Federal Reserve has completed raising interest rates.

Hopes that financial conditions will ease in the new year as inflation eases have boosted risk assets in recent weeks and pushed the dollar lower against its peers.

All three main indexes in New York extended their gains on Monday, with the Nasdaq hitting a 22-month high led by gains from tech giants including Amazon, Microsoft and Nvidia.

Profits were boosted by the successful sale of 20-year US Treasuries, which pushed yields on other notes lower. There is now growing talk that the Fed could cut borrowing costs as early as March, much earlier than previous bets on the second half of 2024.

“Amidst soft US macro data and speculation that the Fed is not only raising rates, but perhaps even ready to implement so-called ‘insurance cuts’ starting in March,” said Stephen Innes of SPI Asset Management. “Some professional investors have been broadly bullish on bonds.” ,

ALSO READ:

Microsoft CEO Satya Nadella suggests Sam Altman could return to OpenAI techcrunch

Koti Khushboo’s business is growing twice as fast as the Chinese market.

Advertisement – Scroll to continue

Hong Kong led the way in Asia, jumping nearly two percent on Monday and contributing more than one percent.

Market heavyweight Alibaba jumped more than three percent to extend its rebound after falling 10 percent on Friday on news that it was canceling the spinoff of its cloud computing arm.

Shanghai, Sydney, Seoul, Taipei and Manila were also up, although Tokyo struggled due to the yen’s strength.

Advertisement – Scroll to continue

The yen has rebounded after hitting a 32-year low of 151.95 against the dollar in October as U.S. rate expectations eased and speculation that the Bank of Japan is considering a move away from its ultra-loose policies. Used to be.

The greenback was also down against the euro and pound.

Still, while traders are getting comfortable with the idea of a rate cut in the new year, Fed officials remain cautious.

Advertisement – Scroll to continue

In the latest comments, Richmond Fed President Thomas Barkin warned that the bank still has a lot of work to do to reduce inflation, which at 3.2 percent is still well above target.

“The economy is still growing — unemployment is still at 3.9% and … inflation seems to be stabilizing. So it’s all good,” he told Fox Business.

“But the job is not done, and so you have to wait until the job is done, and we’ll see where we get.”

Advertisement – Scroll to continue

He said that “with inflation being stubborn”, he is in favor of keeping rates high for an extended period, but for how long will depend on incoming data.

Traders are now awaiting the release of the minutes of the Fed’s November policy meeting, when they set rates, while comments from officials will also be released ahead of their final meeting of the year on Dec. 12-13.

TOKYO – Nikkei 225: down 0.2 percent at 33,338.29 (break)

Advertisement – Scroll to continue

Hong Kong – Hang Seng index: up 1.5 percent at 18,036.96

Shanghai – Composite: up 0.6 percent at 3,087.02

Dollar/yen: fell to 148.01 yen from 148.31 yen on Monday

Pound/Dollar: Up from $1.2502 to $1.2512

EUR/USD: up from $1.0945 to $1.0949

Euro/pound: up from 87.48 pence to 87.50 pence

West Texas Intermediate: down 0.1 percent at $77.79 a barrel

Brent North Sea crude: down 0.1 percent at $82.24 per barrel

New York – Dow: up 0.6 percent at 35,151.04 (close)

LONDON – FTSE 100: down 0.1 percent at 7,496.36 (close)

Source: www.barrons.com