Baladna Q.P.S.C announced its results for the first half of 2022 (the period from January 1 to June 30, 2022).

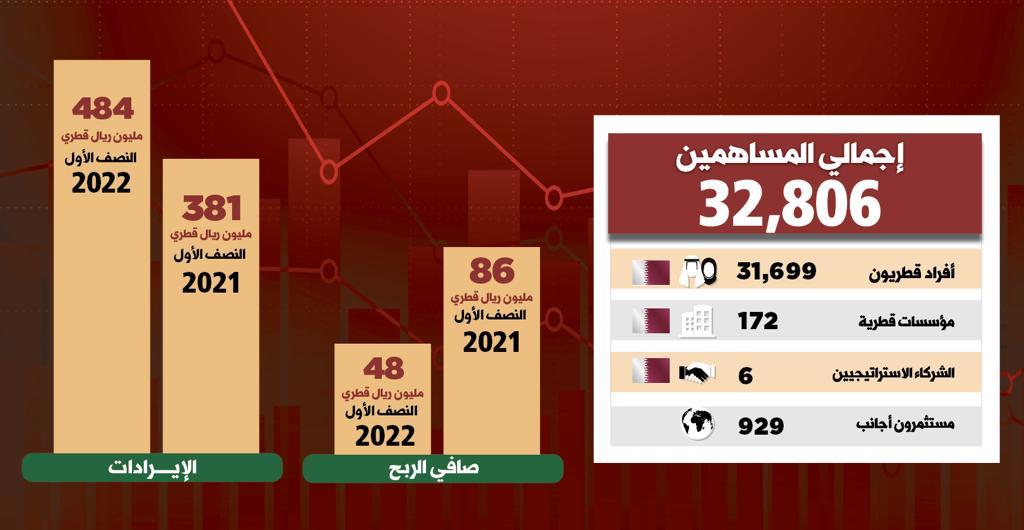

Baladna achieved revenues of QR 484 million (annual growth rate of 27%) and net profit of QR 48 million (annual decrease of 45%) for the first six months of 2022, compared to revenues of QR 381 million and net profit of 86 million Qatari riyals for the same period last year (first half of 2021).

Baladna has managed to raise the market share of most product categories by increasing sales volume, and has also improved its product portfolio by introducing new products with high cumulative value and deleting low-performance products.

Baladna also achieved significant growth in revenues in the second quarter of 2022, amounting to 245 million Qatari riyals, compared to 239 million Qatari riyals in the first quarter of 2022. The net profit for the second quarter of 2022 amounted to 22 million Qatari riyals compared to By 26 million Qatari riyals in the first quarter of 2022.

The significant rise in international commodity prices, especially the costs of feed, raw materials and packaging materials, had a significant negative impact on the achieved profit margins, and this impact will increase in severity during the remainder of the current year, The company still uses a portion of the old inventory that was purchased at the old prices before they rose.

As our country is currently working on obtaining the approval of the official authorities in order to increase the selling prices of its products, similar to the companies operating in the same sector in the region, where these companies obtained approvals to increase prices more than once.

In order to mitigate the impact of the increase in the prices of raw materials on the company’s profitability, Baladna focused on increasing the volume of sales in both the retail sector and the hotel, restaurants and cafe (HORECA) sector. Moreover, our country has been able to increase operational efficiency rates and continue to control public expenditures.

In the first half of 2022, Baladna succeeded in achieving a higher milk productivity of 38.9 liters per cow per day compared to 38.3 liters in the first half of 2021.

Moreover, lower sales losses, increased manufacturing efficiency, and controlling overheads supported margins profitability.

Baladna achieved cash profits of 11 million Qatari riyals in the first half of 2022 from its investment portfolio of 210 million Qatari riyals as on June 30, 2022 (the dividend contributed 11 million Qatari riyals to net income in the first half of 2022). An unrealized loss was recorded in the first half of 2022 from those investments of 11 million Qatari riyals (Baladna had previously recorded unrealized profits of 10 million Qatari riyals in the 2021 fiscal year from these investments).

As indicated in previous disclosures, the construction of the evaporated milk processing plant is progressing well and as planned, and it is expected that construction and foundation works will be completed by the end of 2022 and the plant will be fully operational at the beginning of 2023.

With the start of the FIFA World Cup 2022 in Qatar, our country expects strong revenue growth. This event represents an important opportunity to increase sales to the retail sector and the hotel, restaurant and cafe (HORECA) sector. The company has already prepared for this tournament and put in place the necessary plans to meet the expected additional demand.

Baladna’s strategic focus remains on creating shareholder value and enhancing food security and self-sufficiency in Qatar by offering superior quality products, expanding product portfolio, and focusing on operational efficiency across the entire value chain.

- News

- News of Welcome Qatar Company

- Political News

- Qatar News

- Social News

- Sport News

- Technology News

- World News

Baladna achieves a net profit of 48 million Qatari riyals in the first half of 2022