Around 12,500 jobs at risk as Wilko goes into administration

The chain’s CEO Mark Jackson said management would work with administrators PwC to “preserve as many jobs as possible” across the chain’s 400 stores.

By Daniel Binns, business reporter

Thursday 10 August 2023 14:58, UK

Listen to this article

0:00 / 3:50

1X

BeyondWords

Audio created using AI assistance

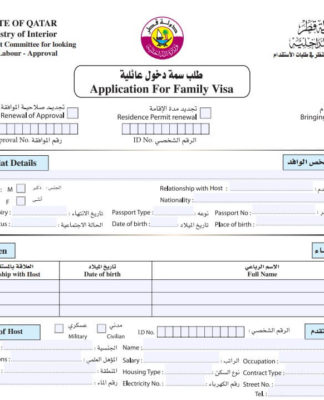

A branch of the discount retail homeware store Wilko is seen in London, Britain, August 3, 2023. REUTERS/Toby Melville

Why you can trust Sky News

All Wilko stores will remain open for now despite the firm’s collapse on Thursday morning, administrators have said.

Around 12,500 jobs at the discount homeware retailer are at risk after the company announced attempts to rescue the chain had failed.

It came after Sky News revealed earlier that Wilko was only hours away from insolvency.

PwC will handle the administration for the chain, which has around 400 stores.

Joint administrator Zelf Hussain said: “It is incredibly sad that a well-loved, family business that has been on the high street for over 90 years has had to go into administration today. I know the management team has left no stone unturned in trying to save the business…

“As administrators we will continue to engage with parties who may be interested in acquiring all or part of the business. Stores will continue to trade as normal for the time being and staff will continue to be paid.”

Are you currently employed by Wilko and concerned about your job? You can contact Sky News via WhatsApp here, via email on news@skynews.com or by sending a text to 07583 000 853.

In an earlier statement, CEO Mark Jackson said: “We’ve all fought hard to keep this incredible business intact but must concede that time has run out and now, we must do what’s best to preserve as many jobs as possible, for as long as is possible, by working with our appointed administrators.”

Mr Jackson said there had recently been a “significant level of interest” from other firms in Wilko, “including indicative offers that we believe would meet all our financial criteria to recapitalise the business”.

But he added: “Without the surety of being able to complete the deal within the necessary time frame and given the cash position, we’ve been left with no choice but to take this unfortunate action.”

The threat of collapse had been hanging over Wilko for weeks, and intensified last Thursday when the company filed a notice of intention to appoint administrators, giving it 10 working days of protection from creditors.

Nadine Houghton, national officer at the GMB union, said the workers facing potential redundancy “will take little solace that with better management the situation that has befallen Wilko was, sadly, entirely avoidable”.

“GMB has been told time and time again how warnings were made that Wilko was in a prime position to capitalise on the growing bargain retailer market, but simply failed to grasp this opportunity.”

Read more from business:

‘Rise in staff working from home’ as cost of living bites

Halifax becomes latest lender to cut mortgage rates

Rents ‘to continue to rise’ as supply falls below demand

The 93-year-old chain, which was founded in 1930 in Leicester, suspended home deliveries on Wednesday as it raced to secure a rescue deal.

Like many high street retailers, Wilko has been hit by inflationary pressures and supply chain challenges.

But last month a spokesperson for the company described talk of administration as “unfounded”.

It is Britain’s biggest retail collapse since McColl’s in May last year. The firm was later bought by supermarket group Morrisons.

Commenting on the collapse, Tom Davey, a director at Factor Risk Management, said: “The predicted perfect storm of rising prices coupled with higher mortgage rates has finally hit UK consumers’ spending power, with nasty knock-on effects for the retail industry.

“After a torrid period during the pandemic, and with continued supply issues and rising interest rates, many retailers will find the conditions impossible to survive in their current guise and we expect to see an increasing number of high-profile companies restructuring and facing fire sales as a result of this.”

Related Topics

Retail

UK Economy