THE DIGITAL ECONOMY

Digitalization helps promote financial inclusion among ASEAN youth. Here’s how

Dec 7, 2022

Digitalization can help make access to financial services more inclusive for ASEAN’s digital generation.

Image: Unsplash/rupixen

Johnny Wood

Writer, Formative Content

Share:

OUR IMPACT

What’s the World Economic Forum doing to accelerate action on The Digital Economy?

THE BIG PICTURE

Explore and monitor how The Digital Economy is affecting economies, industries and global issues

CROWDSOURCE INNOVATION

Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:

The Digital Economy

Listen to the article

7 min listen

Digitalization can help make access to financial services more inclusive for ASEAN’s digital generation.

Women, micro business owners and rural communities are underserved and experience gaps in accessing financial services in the region.

Increasing both digital and financial literacy can help ASEAN’s digital generation navigate app-based and online financial services safely and proficiently.

Digitalization can unlock greater financial inclusion among the Association of Southeast Asian Nations’ (ASEAN) digital generation, according to a new report. But there is still work to do.

The ASEAN region has seen unprecedented growth in digitalization, and this trend looks set to continue, according to the World Economic Forum’s ASEAN Digital Generation Report 2022. The uptake of digital financial services is also increasing across the region.

However, the report found that women, micro-business owners, rural communities, and other underserved groups experience gaps in accessing financial services in the region.

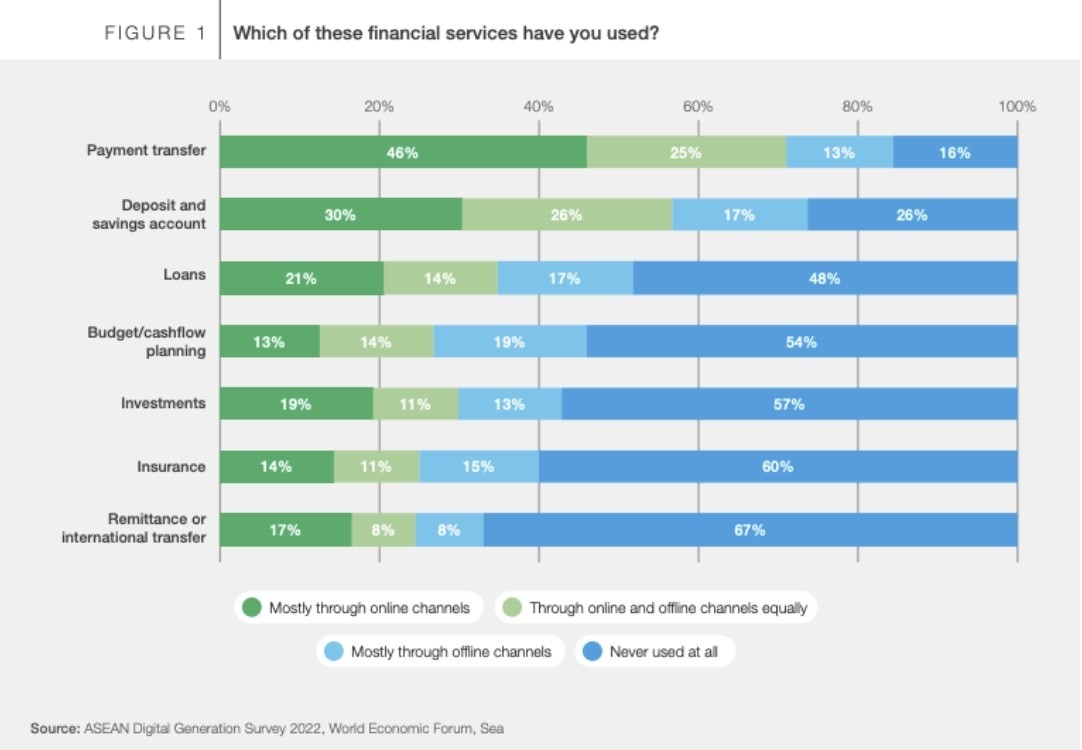

Survey showing which re

84% of survey respondents said they had used digital payment apps. Image: WEF

Digital payment apps were the most used by those surveyed of any applications after social media, with 84% of all respondents saying they had used these apps.

Access to finance

Those surveyed stressed the importance of improved access to financial services for both personal and business needs, including for cash flow, savings and business expansion.

However, there were inconsistencies in accessing finance for ASEAN’s digital generation. For example, nearly half of those seeking credit support could not access formal spending sources.

And 28% of people seeking loans were unable to secure finance, leaving almost a fifth of respondents relying on less traditional sources of funding, including family and friends, cooperatives or other informal lending options.

The survey found that women have less access than men to loans and financial services. Just 22% of women needing loans received credit from commercial banks, compared to 28% of male applications. Fewer women (19%) than men (28%) used advanced financial products like credit, investment and insurance, too.

ASEAN Women are adopting more financial services apps than men, however.

Learning how to manage personal finances improves access to investment services.

Learning how to manage personal finances improves access to investment services. Image: ASEAN

The report, now in its sixth edition, surveyed 90,000 people – predominantly aged 16-35 – across six ASEAN nations: Indonesia, Malaysia, the Philippines, Singapore, Thailand and Viet Nam. It concluded that developing financial management skills was closely linked with accessing financial products, particularly advanced products like insurance, loans and investments.

Other barriers relate to the complex language used in financial services contracts and ambiguous contract terms.

The survey results also revealed concerns about hidden charges when accessing financial services, as well as security and fraud. Then there are the difficulties of dealing with cumbersome or confusing processes and interfaces for things like digital payments and lending services.

But digitalization has the potential to help tackle these concerns while increasing access to finance for underrepresented groups. Strong digitalization of the region’s saving and payment services paves the way to bring more advanced digitalized financial services into reach, such as investment, credit and insurance.

Graph showing the most used apps in the ASEAN region

87% of survey respondents called for greater digitalization of financial services. Image: ASEAN

There is a consensus among women and men – almost 9 in 10 surveyed – calling for ASEAN’s financial services to be digitalized further.

For micro, small and medium-sized enterprises, better access to financial services is essential to improve cashflow management and foster business growth opportunities.

A strong focus of further digitalization is to make it inclusive. The report notes that stakeholders must work to identify gaps and challenges, improve digital financial literacy and bolster security and safety provisions to create a more inclusive, stable and sustainable digital economy for ASEAN’s digital generation.

Boosting the region’s digital and financial literacy can help people and businesses navigate digital finance safely and proficiently.

DISCOVER

How is the World Economic Forum fostering a sustainable and inclusive digital economy?

Have you read?

South-East Asian SMEs are missing out on the digital revolution. Here’s how to get them on board

How one bank is digitalizing financial inclusion in Indonesia

When it comes to financial inclusion, we cannot afford to leave the vulnerable behind

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics: