BUSINESSEUROPE

Europe’s EV makers grapple with sluggish sales, China shock

Arthur Sullivan

02/09/2024February 9, 2024

The European electric vehicle market is sputtering. Sales in Germany plunged late last year amid concerns over pricing. Meanwhile, in China, the opposite happened as BYD became the world’s bestselling electric carmaker.

https://p.dw.com/p/4cBzx

An electric car plugged into an electric vehicle (EV) charging point

The EV sectors in Germany and Europe still face numerous challengesImage: John Walton/PA Wire/picture alliance

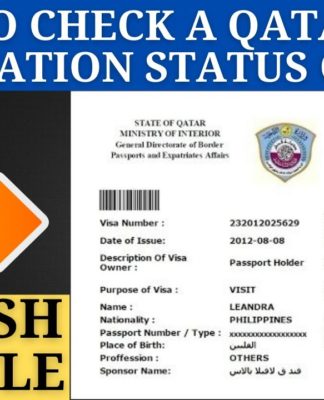

Shortly before Christmas, the German government’s budget problems abruptly hit the country’s electric vehicle (EV) sector.

As part of a wider belt-tightening, Berlin ended a seven-year subsidy scheme known as the “Umweltbonus” (“environmental bonus”), which had seen consumers get purchase grants of several thousand euros when they bought electric cars.

The news compounded a challenging few months for the EV market in Germany. A few months earlier, the government had already ended the subsidy scheme for corporate fleet buyers, which account for around two-thirds of the German car market.

That goes some way to explaining why new EV registrations fell sharply in Germany in November and December. The European Automobile Manufacturers’ Association said electric car sales in Germany plunged by 48% in December. For the EU on the whole, sales of fully electric cars fell by 17%.

A bump in the road?

The question for the sector is whether this is just a bump in the road or something more serious.

Patrick Schaufuss, a partner at the McKinsey Center for Future Mobility, said EV sales were “flat” in Europe in 2023 due to a decline in plug-in hybrid electric vehicles (PHEVs).

“This has been driven by no or limited subsidies for PHEVs and few new models for this transition technology,” he told DW. He expects 2024 to be similarly flat but forecasts an improvement in 2025 and 2026 as more affordable models become available.

Man inspecting the hood of a VW ID.3Man inspecting the hood of a VW ID.3

EV sales slumped in Germany in November and December 2023Image: Robert Michael/dpa/picture alliance

Mike Tyndall, head of European automotive equity research at HSBC, said growth for EVs in Europe in 2023 was “quite strong” overall, but he also recognized a potential gear shift.

“Where the challenge comes is that there was an expectation that growth would be stronger; it would accelerate,” he told DW. “So as we started to see adoption pick up, we would see this, if you like, acceleration. And in contrast, it would appear that we’re seeing growth slow.”

The cutting of subsidies drew attention to one of the central questions around EV penetration into overall car sales in Europe: affordability. Since late 2023, carmakers in several European countries have been offering higher discounts on electric vehicles in an attempt to attract buyers.

EVs are typically more expensive than similar vehicles powered by gas. Tyndall believes that as the EV market tries to attract mainstream buyers, rather than so-called “early adopters” who were more easily persuaded to buy an electric vehicle from the outset, cost is becoming more of an issue.

“You get a far more cost-conscious consumer that, given the pricing on EVs at the moment, is probably a little bit more reticent to make the transition,” he said.

Added to that are existing perceptions among consumers that charging infrastructure and battery performance are still not good enough to justify taking the plunge. But Tyndall believes such concerns will gradually fade as technology and infrastructure improve over the next few years.

Major automakers make big electric vehicle bet

For major European carmakers such as Volkswagen, the stakes couldn’t be higher. In March 2023, the German carmaker announced plans to invest €180 billion ($194 billion) between 2023 and 2027, with more than two-thirds of that targeting electrification and digitalization.

Volkswagen ID GTI Concept car exhibited at a car show Volkswagen ID GTI Concept car exhibited at a car show

Affordability has been an issue for electric carmakersImage: Sven Hoppe/picture alliance/dpa

Volkswagen has staked its future on the transition to EVs. It wants 80% of its sales in Europe to be EVs by 2030, with a 55% target set in the US for the same year.

Volkswagen EV sales increased by 21% worldwide in 2023. A spokesperson for the company told DW that while they expect the sales environment to be “challenging” in 2024, they believe the 2023 figures overall show that they remain on “the right track.”

“We are firmly convinced that the future will be electric and are resolutely driving forward the mobility transition,” the spokesperson said.

Tyndall said companies like Volkswagen and Stellantis, which owns brands such as Peugeot, Fiat and Opel, are acutely aware of the need to balance affordability with profitability. However, he expects a degree of anxiety over the way the market has shifted in recent months.

“They will be nervous that this potentially builds into something more where perhaps there is an underlying reason above and beyond the ones we’re mentioning that’s causing people not to buy EVs,” he said.

Balancing the China ‘shock’

One market where Volkswagen has been determined to win territory in electric vehicles is China. It spent around $5 billion in 2023 alone in an attempt to take on rivals such as Tesla and BYD in the world’s biggest car market.

China looms large over the EV markets in Europe and the US. The rise of Chinese EV makers such as BYD has been dramatic. While European EVs experienced a major slump in December, BYD enjoyed a record surge. Its sales increased by 70% in December as it sold a record 526,000 battery-only vehicles in the final quarter of 2023. That took it ahead of Tesla as the world’s bestselling electric carmaker.

BYD’s success has largely been within the domestic market in China, but it’s increasingly targeting markets in Europe and the US. A key reason why BYD and other Chinese EV makers think they can thrive in Europe is pricing.

BYD models on display at the Munich auto show, people milling around them BYD models on display at the Munich auto show, people milling around them

China’s BYD recently became the world’s bestselling electric carmakerImage: Leonhard Simon/REUTERS

“European battery-electric vehicles [BEVs] are usually 15-20% more expensive than comparable internal combustion engine cars,” said McKinsey’s Schaufuss. “In China, the difference is only 10%, and many Chinese BEVs are already cheaper than European ICE cars today.”

However, that doesn’t automatically translate into success for Chinese EVs in Europe, said Tyndall.

“The China EV market is not a healthy market,” he said. “There is an absolute swath of manufacturers making fantastic products, but very few of them are making money.” He expects consolidation in the market, and he also expects companies such as BYD will not be aggressive on pricing in Europe.

“They are trying to win on the basis of substance and brand,” he said. “And for me, that will take a long time. You need deep pockets, as in profits, to fund that. And you need patience.”

Why big automakers are losing China

16:15

Volkswagen said Chinese competitors will not be able to win in Europe based on price alone. “Foreign competitors in Europe also have to adapt to the specific requirements of the market,” the company said, adding that “Chinese competitors cannot offer their cars as powerfully and cheaply as in China.”

However, it added that it welcomes competition and takes Chinese suppliers seriously.

“Just like we did with the Japanese and Koreans,” the spokesperson added.

Edited by: Ashutosh Pandey