BUSINESS

France-China trade ties: ‘There is a greater risk due to the current geopolitical climate’

Issued on: 07/04/2023 – 21:04

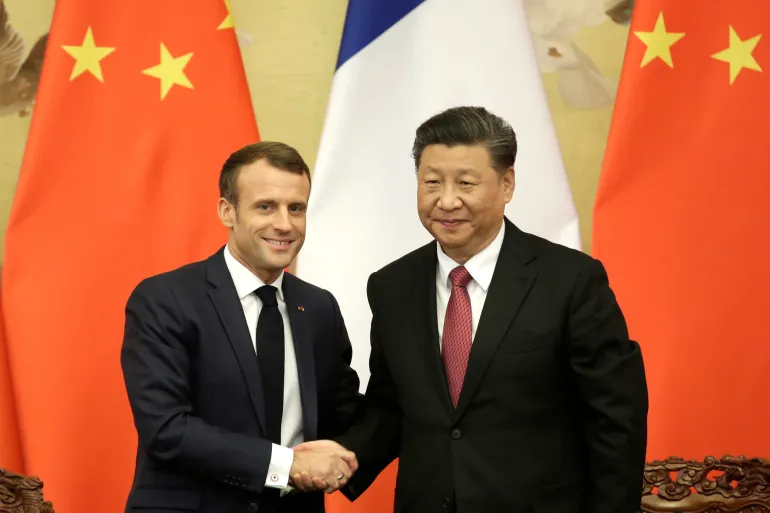

The French flag flies in front of the Great Hall of the People prior to the start of the welcome ceremony of France’s President Emmanuel Macron in Beijing, China, Thursday, April 6, 2023.

The French flag flies in front of the Great Hall of the People prior to the start of the welcome ceremony of France’s President Emmanuel Macron in Beijing, China, Thursday, April 6, 2023. © Thibault Camus, AP

Text by:

Natasha LI

4 min

Emmanuel Macron, accompanied by top French business executives, concluded his trip to China on Friday with a visit to the southern city of Canton, where he met with more Chinese investors. With trade talks on the agenda, several deals between companies from both countries have already been sealed during the French president’s first visit to China since the Covid-19 pandemic. A French economist shares with FRANCE 24 her insight on the concerns surrounding trade ties between Paris and Beijing.

Business is in the air as Airbus announced on Friday that it would deliver 50 helicopters to GDAT, one of China’s largest helicopter lessors. The announcement was made only a day after Airbus pledged to double production in China by setting up a second assembly line at its Tianjin plant. Meanwhile, French national electricity company Électricité de France (EDF) renewed its contract with Chinese energy giant China General Nuclear Power Group (CGN). Cosmetics leader L’Oréal sealed a deal with e-commerce platform Alibaba on ‘sustainable consumption’ while water and waste management company Suez clinched a desalination contract with China’s Wanhua chemical.

This series of freshly inked business deals, highlighted by Macron’s trip to China, seems to show France’s positive outlook on business in China. FRANCE 24 talked to Mary-Françoise Renard, an economics professor at the University of Clermont Auvergne and director of the Institute of Research on China’s Economy, to shed light on current Sino-Franco trade relations.

FRANCE 24: What kind of signals do these business deals send? Do they represent a broadening of current trade relations between Paris and Beijing?

Mary-Françoise Renard: It’s a good sign, of course! It means that businesses are going smoothly for French companies in China, so it’s good news. But this doesn’t necessarily represent significant changes to current trade relations between France and China as the recently sealed deals are prepared a long time in advance. Despite this being President Macron’s first visit since 2019 to China, commercial transactions between the two nations have never ceased during this period. We did, indeed, witness throughout the past three years a slowing down due to constraints imposed by the pandemic, during which China shut down its borders. But it’s part of the global trend, economic activities across countries decreased in the same period. We’re really just picking up where we left it before Covid.

Despite a generally positive outlook, several industry players have cited concerns over continuing to conduct business in China and advocate for a more cautious approach. Do you share such concerns?

The concerns [of French businesses trading with China] are well grounded. There is a greater risk due to the current geopolitical climate as well as increasing interventions from the Chinese Communist Party. Government intervention has already been heavily present in China, but it has become much more prominent [China’s government has imposed party units in private companies since 1993, a policy that has expanded under Xi Jinping]. Companies are left with little wiggle room, which inevitably leads to a certain cautiousness, even wariness that was much less noticeable in the past.

Does that mean that only multinationals and large corporations can afford to take the risk of trading with China?

I would like to point out a particularity in France’s industrial fabric, which is far from being new: France has a lot of large companies and a lot of small companies. What we don’t have are medium-sized companies, contrary to Germany, for example. And it’s much riskier for a small company to export goods, especially to China. The company would need to hire export managers with good knowledge of China’s market and know-how, which can be very costly. It’s much easier for large corporations, which already have the necessary resources at hand and can, eventually, afford to fail. Unfortunately, due to structural reasons and the current economic conjuncture, France does not have medium-sized companies that can also afford to take on such a risk.

According to statistics published by French customs, France’s trade deficit vis-à-vis China continued to widen to €39.6 billion in 2021, a now decades-long trend. Is there any potential improvement in sight?

France’s trade deficit is essentially due to the structure of the country’s foreign trade. We export various services to China which award us with surpluses (€6.1 billion in 2021), but we import a lot more goods (€77.7 billion in 2021) which ultimately leads to a deficit in our trade balance with China. And the widening of our trade deficit is partly the result of recovering household consumption in France as well as growing industrial output, which drove the demand of imported materials. Structurally speaking, France suffers from a lack of competitiveness on goods for household consumption, such as electronics, clothing and other daily-use products. The deficit is here to stay, and [it’s not necessarily a bad thing] if we hope to maintain the current level of household consumption.

The World Trade Organization on Wednesday published a report forecasting a global decrease in trade growth to 1.7% for this year. How much would this impact trade between Paris and Beijing?

Of course, we cannot exclude extraordinary events, or in any case, events that occur earlier than predicted such as the Ukraine war. But in the current context of things, it is very likely that we will witness a slowing down of business transactions between France and China due to high inflation, growing geopolitical tensions and protectionist policies set in place by the US.

Part of the US’s protectionist policies can be found in the Inflation Reduction Act (IRA) passed last August that openly targets China. Do you think this divide might bring Europe and China closer?

It’s very hard to predict. The US’s policies would probably not directly alter Europe’s economic strategies towards China. The latter would most certainly attempt to profit and seduce Europe, as the US’s IRA alienates even its European partners. However, Europe pursues a strategy that is more centred on diversifying risks than decoupling [from the US]. For now, Europe continues to develop its relations with China independently through trade and dialogue.

![How to get a Qatar Family Residence Visa? [ Updated ]2022](https://welcomeqatar.com/wp-content/uploads/2022/04/maxresdefault-2-324x400.jpg)