Qatar National Bank: An expected rise in oil prices in the coming period

December 17, 2022 12:06 pm

Follow us:

alsharq

oil

A+

A-

National Bank of QatarOil prices

Doha – Qena

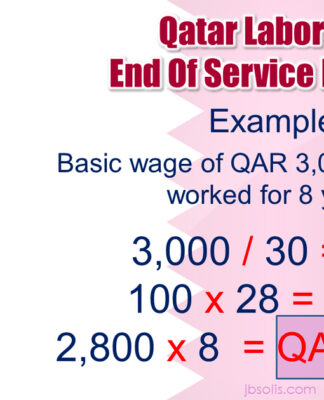

Qatar National Bank expected a further rise in oil prices, pointing to the possibility of a decline in supply in the markets against the backdrop of supply constraints and increased global demand. He also expected prices to be well supported in a range of $90 to $115 per barrel over the coming quarters.

Read also

China’s cyclical recovery will be delayed by the current wave of the COVID-19 pandemic

QNB: Growth in the UK will be negatively affected

Qatar National Bank: Growth in the United Kingdom will be negatively affected by weak supply and demand factors

Qatar National Bank stated in its weekly report that the oil markets have been witnessing unprecedented bouts of fluctuations and turmoil since the outbreak of the Corona pandemic in early 2020, adding, “In fact, the external shocks in the oil markets were so great that prices witnessed sharp upward and downward fluctuations.” over a relatively short period of time.”

The report attributed the possibility of a continued rise in oil prices in the future to two factors: First, oil prices are not very high in relative terms, as the current total cost of oil demand constitutes approximately 3.6 percent of the nominal global GDP, which is much lower than the alarming historical percentage. of 5 percent of GDP, at which the “oil price burden” begins to negatively affect consumption and investment. The last time such an event of a 5 percent price burden occurred was during the global financial crisis in 2008.

The report pointed out that the global economy could accept Brent crude prices at the level of $140 a barrel before global demand was significantly affected, explaining, “At the time of writing this report, Brent crude prices rose by more than 20 percent from the levels recorded before the pandemic at the end of 2019.” to the current level of around $80 per barrel. This level is more or less in line with other major asset classes and commodities, such as copper, gold and the S&P 500 US stock index, which means that oil prices are following the general trend (of asset inflation) post-pandemic.”

In dealing with the second factor, the report predicted that the balance of supply and demand would turn into a deficit in volumes during the coming months. On the supply side, OPEC+ countries are already planning to cut oil production in order to keep prices above certain levels. Tougher European sanctions on Russian crude exports will begin to be implemented, including setting new price ceilings for Russian supplies, further disrupting energy trade. Shipping and transportation bottlenecks will prevent the full rerouting of Russian oil exports from Europe to Asia, which will then reduce Russian oil supplies. In addition, the US government will be forced to stop selling crude oil from its Strategic Reserve as inventories are rapidly declining to multi-decade lows, threatening the country’s energy security.

On the demand side, after several quarters of negative reduction in economic growth rates by analysts and international organizations, there is now room for more positive expectations. In fact, we expect stronger economic growth than previously expected in all major economies during the next two quarters, including Including the United States, Europe and China.High-frequency data indicates strength in the consumption sector in the United States.The winter in Europe is likely to be warmer than expected, which indicates that the impact of the energy crisis will be less.China is set to benefit from the recovery With its gradual abandonment of the policy of zero Covid-19 and its continuation of the policy of facilitation, the global demand for oil will increase.