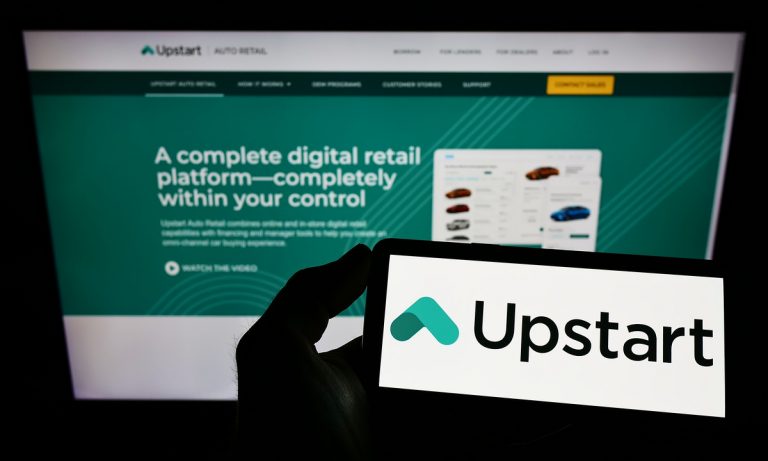

Upstart Stock Plunges 34% After Lower-Than-Expected Guidance

BY PYMNTS | AUGUST 9, 2023

|

Artificial intelligence (AI) lending platform Upstart saw its stock plummet 34% Wednesday (Aug. 9).

This follows the company’s delivery of an outlook for the third quarter that was lower than expected, Bloomberg reported Wednesday.

The decline comes after a monthslong rally for the stock that reached 445% at one point, according to the report.

The previous surge in Upstart stock was jump-started when the company reported its first-quarter results in May alongside a second-quarter outlook that was much higher than anticipated, the report said. It was also bolstered by investors’ interest in companies involved with AI.

At one point in mid-July, the company’s stock rallied around the time it was announced that Arbor Financial Credit Union, a credit union serving Michigan, partnered with Upstart to provide personal loans to more members. The companies said at the time that personal loan applicants on Upstart.com who meet Arbor’s credit policies will receive tailored offers.

About six weeks before, in early June, Upstart gained at a time when the prospect of at least a near-term pause in interest rate hikes had cheered investors on the prospects of lending platforms.

More recently, a majority of Wall Street analysts have recommended sell-equivalent on Upstart, as revealed by data collected by Bloomberg.

Morgan Stanley analyst James Faucette weighed in on the matter, stating, per the report, “Fade what appears to be a low-quality rally.” Meanwhile, Dan Dolev of Mizuho Securities commented, “I think some of the air is popping out of that balloon today.”

Lance Jessurun of BTIG suggested otherwise, issuing a buy rating on the stock and noting, per the report, “Outside of the disappointing 3Q guide for top-line, the quarter was actually pretty strong.”

During Upstart’s quarterly earnings call Tuesday (Aug. 8), CEO Dave Girouard said the company expects that when the funding markets return to normal, becoming less cautious than they are now, the company’s continuing investment in AI will have it in the pole position.

Already, during the second quarter, the company reached a record percentage of automated unsecured loans, with 88% being approved with “no waiting, no documents to upload and no phone calls.”

“Regardless of the economy’s direction in the coming months, I’m confident that we’re building a better, stronger enterprise for the future,” Girouard said during the call.

![How to get a Qatar Family Residence Visa? [ Updated ]2022](https://welcomeqatar.com/wp-content/uploads/2022/04/maxresdefault-2-324x400.jpg)