FREE ARTICLE Join Over Half a Million Premium Members And Get More In-Depth Stock Guidance and Research

Why Airbnb, Roku, and DraftKings Plunged Today

By Billy Duberstein – Apr 5, 2023 at 1:55PM

KEY POINTS

The March ISM Services PMI survey came in below expectations.

The same goes for the March ADP employment report.

The combination has spurred recession talk, which is heavily affecting consumer discretionary names.

Motley Fool Issues Rare “All In” Buy Alert

NASDAQ: ROKU

Roku

Roku Stock Quote

Market Cap

$9B

Today’s Change

(-6.34%) -$4.19

Current Price

$61.93

Price as of April 5, 2023, 2:04 p.m. ET

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

Today’s ISM Services and ADP payroll readings pointed to a big slowdown in a previously strong part of the economy.

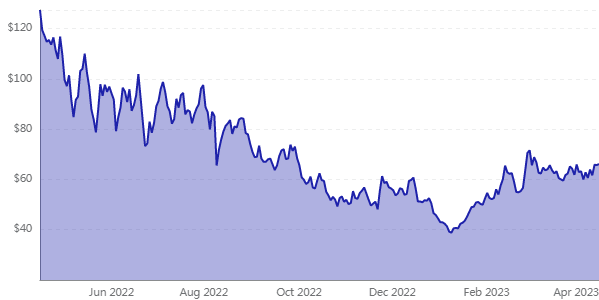

What happened

Shares of consumer services-focused stocks such as Airbnb (ABNB -2.62%), Roku (ROKU -6.34%), and DraftKings (DKNG -5.59%) all fell hard on Wednesday, declining 3%, 5.8%, and 5.3%, respectively, as of 1:22 p.m. ET.

The across-the-board declines on relatively little company-specific news points to a broader macroeconomic factor in today’s decline. Thus, some March economic data releases today were almost certainly the driving factors.

Specifically, today’s Institute for Supply Management’s (ISM) Services Purchasing Manager’s Index (PMI) for March came in cooler than expected. In addition, the Automatic Data Processing employment report for March came in well below expectations.

Softer economic data points to a slowing of the economy and potentially a recession, which would affect companies exposed to consumer discretionary spending, such as these three stocks.

Collapse

shape

NASDAQ: ROKU

Roku

Today’s Change

(-6.34%) -$4.19

Current Price

$61.93

YTD

1W

1M

3M

6M

1Y

5Y

PRICE

VS S&P

ROKU

KEY DATA POINTS

Market Cap

$9B

Day’s Range

$61.12 – $65.39

52wk Range

$38.26 – $134.10

Volume

6,099,488

Avg Vol

9,551,798

Gross Margin

46.09%

Dividend Yield

N/A

Should you invest $1,000 in Roku right now?

So what

Today, the ISM Services PMI came in at 51.2, a reading that still suggests expansion but is well below the 54.5 expected and the 55.1 reading in February. Each factor within the index, including prices, employment, business activity, and new orders came in below expectations, although above 50, except for supplier deliveries, which came in at 45.8, below expectations and suggesting a contraction.

In a way, the report is good news, as the tepid growth and contraction in inventories suggests the Federal Reserve’s interest rate increases are having their intended effect, and that inflation may cool significantly in the months ahead. The non-housing services sector has really been the standout in terms of problematic inflation over the past six months, with goods and housing inflation already on the decline. So, this points to perhaps the last pillar of strength in the economy finally giving way to the tightened financial conditions over the past year. In addition, the regional banking crisis that emerged during early March likely had an effect on cooling demand.

And the ADP Employment Index, which is a private sector model for jobs growth in the country and not an official government reading, was released today. That showed just 145,000 jobs added in March, well below the 210,000 that was expected and down from the 261,000 jobs added in February.

The combination of the two reports suggests the Federal Reserve might not be able to achieve the hoped-for “soft landing” in which inflation comes down without a big spike in unemployment.

If the economy cools due to higher rates and increasing unemployment, that means people won’t be able to afford as many trips using Airbnb, won’t be able to buy as many streaming subscriptions from Roku, or buy as many things from Roku’s advertisers, and might not gamble as much via sports betting apps such as DraftKings. While none of these three companies had specific news this week, Roku did announce last week that it would be laying off another 6% of its workforce, or around 200 people. That follows a previous round of layoffs last November and suggests its growth figures may disappoint in the quarters ahead.

Now what

This has been one of the most anticipated recessions of all time, if we even experience one. Over the past year, consumer-oriented names such as these three have sold off hard; however, if we do have a recession, odds are that it will be much more mild than the Great Recession of 2008. So, once inflation declines toward the Federal Reserve’s 2% target — whether in a recession or not — it may be time to pick up consumer names that have sold off hard to play a recovery.

While it doesn’t appear as though we are there yet, the Fed’s rate increases may be peaking in the months ahead. That means investors should make a list of their favorite consumer names to pick up on a potential downturn.

Billy Duberstein has no position in any of the stocks mentioned. His clients may own shares of the companies mentioned. The Motley Fool has positions in and recommends Airbnb and Roku. The Motley Fool has a disclosure policy.