The Financial Advising House expects Fintech to grow its financial technology services based on a combination of factors represented in:Accelerate the Corona pandemic to strengthen electronic payment systems and expand alternative banking channels and contactless cards with local banks in the context of precautionary and precautionary measures and to ward off virus risks, along with the Qatar Central Bank in March and immediately after the outbreak of the Corona crisis the launch of the Qatar Mobile Payment System (QMP), Which provides a new and safe way for immediate electronic payment after completing the infrastructure and all the requirements of the central electronic payment system at the state level, and in accordance with international best practices in the field of mobile payment services, the system aims to enable the user to use the electronic wallet on his mobile phone to carry out payment operations E-mail from one person to another and payment of the purchase price, in addition to conducting withdrawals and cash feeds for e-wallets immediately and 24 hours a day, 7 days a week. The system also enables the opening of electronic wallets for all users alikeIt contributes to promoting financial inclusion in the country.

A regional center and

made it clear that Qatar is eligible to become a regional center for financial technology in light of the efforts made by the Qatar Central Bank, the Qatar Financial Center and the Qatar Financial Technology Center to develop a sector that provides tremendous opportunities for growth in the Qatari market. Its electronic banking and financing services, electronic payment systems and solutions, financial transfers, electronic wallets, point of sale solutions and payment of bills, while estimates indicate that banks will focus their investments on strengthening cyber security systems to ward off any potential electronic threats and deter any piracy attempts as the Qatari banking sector tops the list of the most secure sectors at the level The Regional Bank of Qatar will lead the implementation of a strategy to ensure the comprehensive growth of electronic banking services at the level of financial institutions subject to its control.

Mass growth

In this context, a study on the role of digital economy in achieving inclusive growth prepared by a professor of Islamic finance at the University of Durham at the University of British Business Professor Habib Ahmed said that the dominance of digital technology in the fourth industrial revolution has the potential to expand economic growth, where digital technology produces a new generation of business models The value creation process changes in terms of both production and supply chain operations using digital technology. Companies use digital technologies in different sectors of the value chain to provide innovative products and services.

The study included in the new issue of the House of Scientific Advice that one of the basic conditions for the use of digital technology for inclusive growth is the ability of all segments of the population to access it and this requires – among other things – a broadband internet connection and the possession of a mobile phone and includes a sustainable business environment for the enabling digital economy Supporting institutions such as telecom companies, phone manufacturers and other companies to assist with payment systems. The electronic payment system would facilitate transactions between different parties in the economy.

Cost reduction

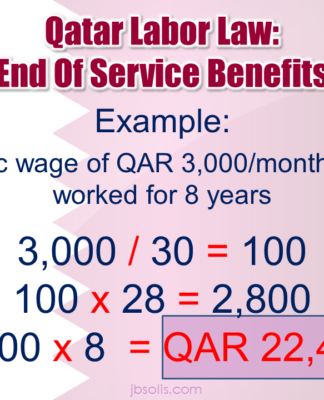

The study pointed out that digital technology relies heavily on artificial intelligence and robotics to automate many of the tasks that were performed by workers. The McKinsey Foundation estimates that approximately 50% of current business tasks can be automated using currently available technologies. The use of digital technologies in the financial sector has the potential to reduce the cost of providing financial services by oscillating between 80% and 90%, and digital payments allow people to Dealing in small amounts, which can create new job opportunities and provide great opportunities for developing e-commerce and services on demand. Also, the information gathered from the big data can be used to develop new credit registration models to provide evaluation to a broader group of clients. Blockchain technology also has the potential to increase transparency and build confidence.