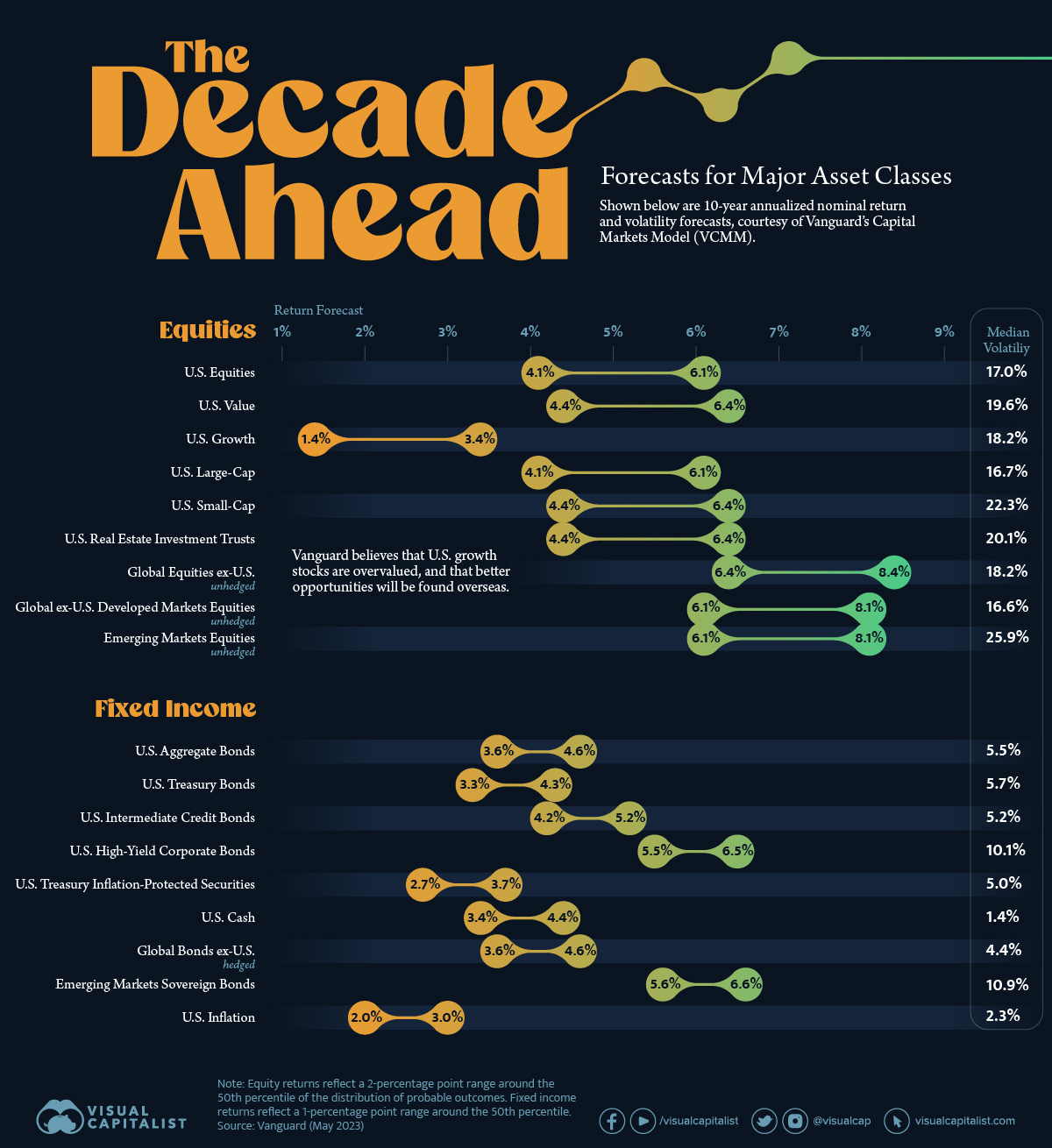

INVESTOR EDUCATION10-Year Annualized Forecasts for Major Asset ClassesPublished 5 days ago on June 14, 2023

By Marcus Lu

10-year annualized forecasts for major asset classes

10-Year Annualized Forecasts for Major Asset Classes

While there’s no way of predicting the future, quantitative models can help us come up with a general idea of how different asset classes may perform in the future.

One example is Vanguard’s Capital Markets Model (VCMM), which has produced a set of 10-year annualized return forecasts for both equity and fixed income markets.

Visualized above, these projections were published on May 17, 2023, and are based on the March 31, 2023 running of the VCMM.

Equity Returns

The equity forecasts from this infographic are listed in the following table.

Asset Class Return Forecast (lower) Return Forecast (upper) Median Volatility

U.S. Equities 4.1% 6.1% 17.0%

U.S. Value 4.4% 6.4% 19.6%

U.S. Growth 1.4% 3.4% 18.2%

U.S. Large-Cap 4.1% 6.1% 16.7%

U.S. Small-Cap 4.4% 6.4% 22.3%

U.S. Real Estate Investment Trusts 4.4% 6.4% 20.1%

Global Equities ex-U.S. (unhedged) 6.4% 8.4% 18.2%

Global ex-U.S. Developed Markets Equities (unhedged) 6.1% 8.1% 16.6%

Emerging Markets Equities (unhedged) 6.1% 8.1% 25.9%

A key takeaway here is that Vanguard expects international equities to outperform U.S. equities over the next decade.

We believe that the valuation-based expansion in U.S. equities is sowing the seeds for lower returns in the decade.

A valuation-based expansion refers to the increase in a company’s market value, rather than its intrinsic value. In other words, Vanguard doesn’t believe that current U.S. equity valuations are justified, and that this will dampen performance over the next decade.

Cited reasons for international outperformance include more favorable valuations, higher dividend payout ratios, and a potentially weaker U.S. dollar.

Fixed Income Returns

Now turning to fixed income, here are the forecasts used in this infographic.

Asset Class Return Forecast (lower) Return Forecast (upper) Median Volatility

U.S. Aggregate Bonds 3.6% 4.6% 5.5%

U.S. Treasury Bonds 3.3% 4.3% 5.7%

U.S. Intermediate Credit Bonds 4.2% 5.2% 5.2%

U.S. High-Yield Corporate Bonds 5.5% 6.5% 10.1%

U.S. Treasury Inflation-Protected Securities 2.7% 3.7% 5.0%

U.S. Cash 3.4% 4.4% 1.4%

Global Bonds ex-U.S. (hedged) 3.6% 4.6% 4.4%

Emerging Markets Sovereign Bonds 5.6% 6.6% 10.9%

U.S. Inflation 2.0% 3.0% 2.3%

Several bond indexes saw record-breaking declines in 2022 thanks to the unprecedented speed of interest rate hikes. Despite this turmoil, Vanguard believes that investors with a longer horizon will actually be better off as a result. The reasoning here is that cash flows can now be reinvested at much higher rates, which over time should offset any declines in an investor’s bond portfolio.

Vanguard also expects U.S. inflation to be contained over the next decade. The firm has confidence in the ability of central banks to keep inflation at their target rates (2% in most developed economies).

![List Of Profession Eligible For Family Visa In #Qatar2022 [Salary Occupations]](https://welcomeqatar.com/wp-content/uploads/2022/07/maxresdefault-1-324x400.jpg)