Why Demographics Only Tell Half the Consumer Digital Adoption Story

BY PYMNTS | APRIL 14, 2023

|

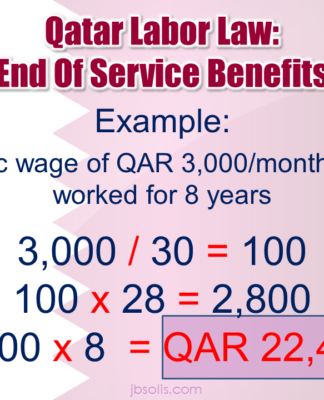

Focusing on just the youngest digital-native generations or only high-earners when describing the connected-tech consumer misses the big picture when it comes to this demographic within a demographic. The connected-tech consumer owns an average of seven to eight connected devices. These may include computers, smartphones, tablets, smart TVs, gaming consoles, smart home technologies and activity trackers. Sometimes also termed “high-tech consumers” or “tech enthusiasts,” this persona reaching across traditional demographics may be best illustrated through the PYMNTS collaboration with PayPal, “Super Apps for the Super Connected.”

Despite the stereotypes, a relatively smaller share of Gen Z, 13%, fits the persona. This is exceeded by the 18% of millennials who are connected-tech and even Gen X’s at 15%. This generational gap may be surprising until considering the recent trend of “dumb phones” among Gen Z.

Who is this connected-tech consumer? What makes them tick? A look into some of PYMNTS’ past research may offer some clues. As this chart demonstrates, a connected-tech consumer is generally driven by convenience, which includes seamless device switching, and defies usual stereotypes, such as the youngest age cohorts being the most tech-savvy.

Instead, the most connected demographic is the millennial generation, which is simultaneously the most connected and most likely to opt for device consolidation when possible, for example, with a super app.

Connected-tech customers flock to restaurants offering online innovations. Seventy-one percent of these high-frequency tech enthusiasts say the quick-service restaurants they frequent offer the ability to pay with their own devices. Another 72% of connected-tech consumers patronizing table-service restaurants say the establishments they visit provide the ability to pay at the table.

Similar tech usage is seen in healthcare.

When it comes to healthcare-related activities, 82% of surveyed connected-tech consumers engage in a mix of both digital and in-person healthcare-related activities, compared to 46% of mainstream-tech consumers. Connected-tech consumers engaged equally with digital-only and in-person-only healthcare activities, at 3.4% and 3%, respectively.

Given their inherently digital-friendly traits, it is perhaps unsurprising that 59% of connected-tech consumers are very or extremely interested in replacing their scattered passwords and stored information with convenient technologies like a credentials vault. This interest represents a double-digit lead over mainstream-tech and basic-tech consumers who said the same, both at 37%.

Connected-tech consumers don’t fall under any one neat traditional demographic. However, it is the very fact that this persona applies across typical demographic profiles that may define the connected-tech consumer instead. Companies and other organizations trying to attract the persona may do well in concentrating on “how digital” they are. Instead of age or financial lifestyle demographics, the connected-tech consumer may be better defined by their digital appetite and ownership of connected devices bringing digital into their worlds.

RECOMMENDED

Consumer Sentiment Inches up in March, Driven by Low-Income Consumers

Digital Platforms Give Banks New Testing Ground for Personalized Experiences

Consumers Scrimp on Restaurant Meals to Stick to Their Budgets

Digital Platforms Reduce Costs and Risk of Business Payments

SEE MORE IN: CONNECTED COMMERCE, CONNECTED ECONOMY, CONSUMER TECH, DIGITAL ADOPTION, NEWS, PAYPAL, PYMNTS STUDY, SUPER APPS FOR THE SUPER CONNECTED

Just 51% of Diners Used Restaurant Loyalty Programs in January

BY PYMNTS | APRIL 14, 2023

|

restaurant

Restaurant loyalty program use has broadly increased in the past year, but that increase has begun to plateau in recent months.

Moreover, quick-service restaurant (QSR) customers remain far more likely to use loyalty programs than table-service restaurant customers, but when offered, consumers will use loyalty programs as they see restaurant food as priced too high, so they crave discount options.

According to PYMNTS research, “Discounts influence consumers’ thinking, even if the effect is modest. The overwhelming majority of restaurant customers like the meals served to them, but they like them a little more when a discount is involved,” as 81% of consumers who paid full price for their meals said the dining experience was satisfactory.

This rises to 86% when (and if) discounts are available, but it depends on the dining venue, with QSR diners having different expectations than those dining at table-service establishments.

Fifty-one percent of restaurant patrons used restaurants’ loyalty programs in January, mostly at QSRs. That makes sense as QSR frequenters are known to be more price sensitive. QSR loyalty programs grew participation by 15% in the last year.

When loyalty programs succeed and whey they fail

Meanwhile, patrons of table-service restaurants showed a greater willingness to pay extra for a better grade of comestibles and a higher-end dining experience. However, that doesn’t mean many table-service diners aren’t interested in a less expensive meal, especially when the food and experience are on a higher level than QSRs.

“For some customers, the lack of a loyalty program is not enough to persuade them to avoid some restaurants,” PYMNTS reported. “Sixty percent of table-service restaurant patrons cited the lack of loyalty programs at restaurants they visited as a reason for not having used such a program in the last 30 days. Twenty-eight percent of QSR customers said they had not used a loyalty program recently because the restaurants they visited did not have one.”

We found that “small restaurants that have or want to establish loyalty programs should consider a diverse set of strategies. Before they launch their own first-party app, they may have to weigh whether they would be better served by linking up with a third-party aggregator that provides a shared app,” as 26% of consumers who had not used a restaurant loyalty program in the last 30 days said they did not want additional apps on their phones, and 32% of consumers who ordered meals from QSRs without using their loyalty programs said the same.