Petal Secures $200 Million to Expand Credit Card Program

BY PYMNTS | AUGUST 3, 2023

|

Petal is preparing to expand its credit card program after securing a $200 million debt facility.

The FinTech announced the funding — from investment firm Victory Park Capital — in a news release Thursday (Aug. 3), saying it would help its goal of issuing cards to consumers who are “new to credit” without needing credit scores to qualify.

So far, the release said, close to 400,000 consumers have been approved for Petal credit cards, including more than 100,000 new cards OK’d last year.

“It will soon be possible for any U.S. consumer to use their banking history to qualify for new and better financial services,” said Petal Co-Founder and CEO Jason Rosen. “That’s great for consumers, and an opportunity for Petal to make credit accessible to millions of people who have been overlooked and underserved for too long.”

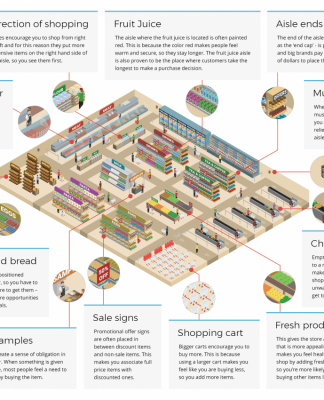

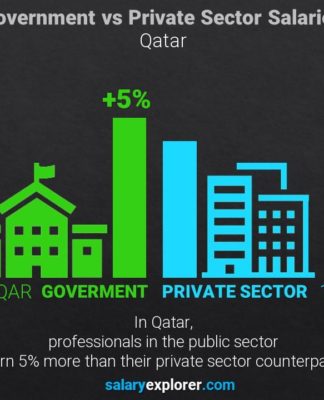

The news is happening at a time when — as noted here in April — the traditional ways of determining credit risk and offering credit are disenfranchising many consumers.

This has opened the door for platforms and alternative data sources that can bolster financial inclusion for the “credit marginalized.”

The PYMNTS/Sezzle report “How Credit Insecurity Is Changing U.S. Consumers’ Borrowing Habits” identified the segment of the population that winds up marginalized due past experience: This is the 25% of all consumers who companies have rejected at least once when applying for credit products.

“We found that credit marginalized consumers are less likely to apply for new credit products,” PYMNTS wrote. “Within that group, 26% of those defined as marginalized say they shy away from applying for new credit because they have low credit scores. Another 21% say that they’d harbored a fear of rejection.”

These consumers find themselves in a vicious cycle: If they apply for credit, they’re likely to be rejected. If they get rejected, they don’t get the chance to build their credit files — and boost their scores. If they don’t boost their scores, they’ll possibly keep getting rejected, or receive credit that’s on less than favorable terms.

Petal’s new debt facility comes three months after the company raised new funding and spun off its Prism Data business, yielding two independent FinTechs that leverage open banking data to expand access to financial services for consumers without accurate credit scores.

Prism Data, which has been Petal’s subsidiary focused on business-to-business (B2B) data infrastructure and analytics, will offer cash flow underwriting technology to financial institutions, FinTechs and other businesses that leverage it to build products and make credit decisions.