Trading on terror: Investigation into Hamas-Israel attack profiteering

Stock market chart displayed on computer screen

By Doloresz Katanich with Reuters

Published on 05/12/2023 – 11:34•Updated 11:49

Share this article

Comments

Israeli authorities are investigating unusual trading activity that took place just days before the 7 October Hamas attacks.

US researchers documented a “significant” spike in market trade speculating on Israeli companies’ decline just days before 7 October, when Hamas militants infiltrated Israel and killed more than 1,200 people.

Law professors Robert Jackson Jr from New York University and Joshua Mitts of Columbia University claim in a preliminary report that unknown traders could have known about Hamas’ plan to attack Israel and used this information to trade on the Tel Aviv and US stock exchanges.

“Our findings suggest that traders informed about the coming attacks profited from these tragic events,” the report claims.

Israel Hamas war: How the financial markets see the outcome of the crisis

Today’s markets: Bitcoin is 150% up, gold flirts with new record

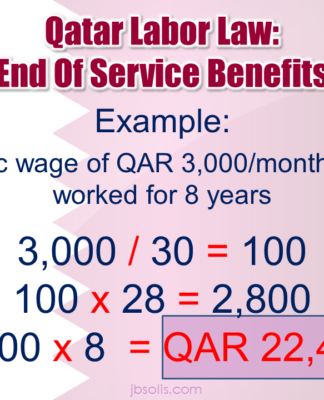

The report, using data from the Financial Industry Regulatory Authority (FINRA), revealed that on 2 October, there was a sudden increase in short-selling transactions, which involved betting against a major exchange-traded fund (ETF) linked to Israeli companies. These transactions aim to profit if the company’s shares, and consequently its market value, decrease in the future.

Similar transactions also surged on shares of numerous Israeli companies on the Tel Aviv Stock Exchange (TASE) in the days leading up to the attacks.

“The short selling that day far exceeded the short selling that occurred during numerous other periods of crisis, including the recession following the financial crisis,” according to the report.

In one example documented in the research, 4.43 million shares of Leumi, Israel’s largest bank, were sold short over the period between 14 September and 5 October. The transaction yielded profits after Leumi’s share price dropped by almost 9% on 8 October in the attack’s immediate aftermath.

“Although we see no aggregate increase in shorting of Israeli companies on US exchanges, we do identify a sharp and unusual increase, just before the attacks, in trading in risky short-dated options on these companies expiring just after the attacks,” Jackon and Mitts said in the report.

The Israel Securities Authority said it is aware of the matter and that “all relevant parties” are investigating it, according to Reuters.

The story of the new study was first reported on Israel’s financial news website The Marker.